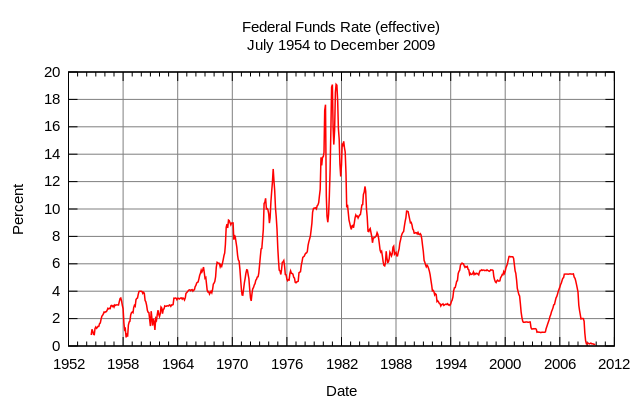

The federal funds rate for June of 2014 is 0.00%-0.25%. This has been the rate since 2009.

The federal funds rate for June of 2014 is 0.00%-0.25%. This has been the rate since 2009.

Monetary policy is “determined by a meeting of the members of the Federal Open Market Committee which normally occurs eight times a year about seven weeks apart.”

The nominal rate is usually when media refers to the Federal Reserve “changing interest rates.”

“Considering the wide impact a change in the federal funds rate can have on the value of the dollar and the amount of lending going to new economic activity, the Federal Reserve is closely watched by the market.” This is very important to all consumers.

It seems that the Fed is continually pumping money into the system to prevent a financial meltdown. If there is an alleged recovery, then why such low interest rates?

As we all should know by now, there’s no recovery and there probably won’t be any looking into the near future. It’s possibly a good time to get a home or car loan because of low interest rates. One might assume that these rates will rise in the future.

When will the federal fund rate start to increase?

[Image Credit: Kbh3rd]