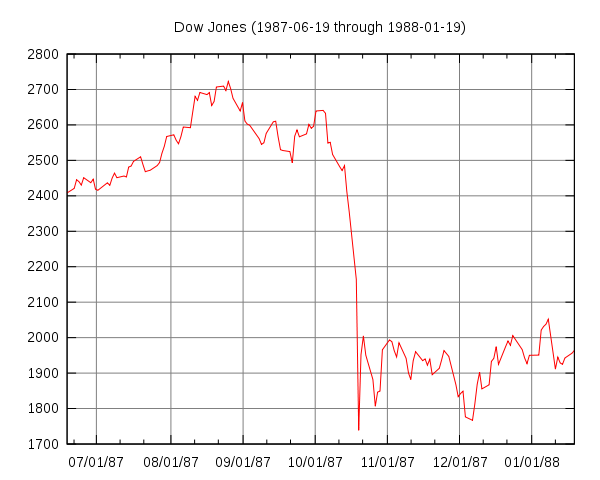

…..Black Monday (October 19, 1987)…………………………………

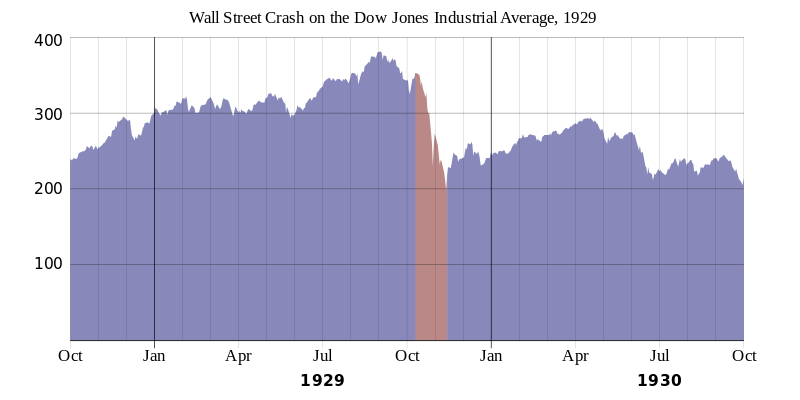

Yes, today’s storyline reads something like China’s ‘Black Monday’ and suddenly there’s panic everywhere. It may be reminiscent of 1929 or Black Monday (1987), but it’s the machination that’s been overhauled, at least in America.

“Black Monday refers to Monday, October 19, 1987, when stock markets around the world crashed, shedding a huge value in a very short time.”

Exploitation by the bankers, especially the dark forces of the central banks, is the theme of the day. Within the past several decades, the Federal Reserve Bank has reached new levels of fraudulency beyond comprehension. Central banks have suddenly started to buy stocks!

The news is relatively new to many of us, however, the voodoo magic has been working for some time. Reagan endured a financial crisis in 1987 and some educated analysts concede that the ‘Working Group‘ has gone outside of its legal limits.

In unusual and exigent circumstances, the Powers that be can alter the rules as necessary, whether it’s legal or illegal.

One is tempted to believe that the Fed has purported to manipulate markets anyway possible; the public usually feels the wind long after the fact.

The Stock Market’s Da Vinci Code sounds like some kind of a weird conspiracy theory to be sure. The Invisible Hand is at it again!

To summarize, the market has been manipulated heavily in the last ten or fifteen years, now all we have to do is connect the dots. The stock market has never risen so quickly in such a short period of time.

Financial institutions are completely out of control and they are juicing the stock market at unprecedented levels.

How long can this voodoo magic continue before the bottom falls out and the whole thing comes crashing down? Let’s party like it’s 1929!

Black Tuesday, October 24, 1929………………………………….